Stagflation

This post will try to cover the basic concept of stagflation along with other inflation and GDP related terminologies.

GDP is the value of all goods and services produced over a period of time.GDP is a "flow" measure, and a healthy economy will have a nice flow of products and services

Nominal GDP is the value of goods and services defined in current prices.Let's say you take a basket of goods and use the "current price"(the price of goods in the year 2020, assume the current year is 2020) to calculate the total value of goods.

Real GDP is the value of goods and services using the base year prices.Let's say you take a basket of goods and use the "base year price"(the price of goods in the year 2019 to calculate the total value of goods.)

GDP deflator = Nominal GDP/Real GDP=Values of goods and services at current year prices/Values of goods and services at base year price.

We have Deflation If GDP deflator is less then one, i.e., when Real GDP > Nominal GDP.We have Inflation If GDP deflator is greater then one, i.e., when Real GDP < Nominal GDP, we have Inflation.The above two concepts of Deflation and Inflation seems fairly intuitive using the GDP deflator.

Lets now view this concept from an inflation rate perspective,

Inflation rate is a defined as percentage change in price index

A sustained increase in inflation rate is Inflation , and a continuous decrease in inflation rate is Deflation. Also, we can now see Inflation and GDP are positively correlated. Deflation will have negative inflation rates..

Let's also cover the other two concepts related to inflation rates before we get into stagflation.

Hyperinflation: A condition of the extreme increase in the inflation rate. for example 400%,500%, or 1000% increases in inflation rates . Hyperinflation is a super bad condition for a countries economy. To give some perspective, the US Federal Reserve has a target inflation rate of 2%.

What is Disinflation? Disinflation is a condition of a temporary decline in the inflation rate. Let's say for a short period, the inflation rate decreases from 9% to 7%. However, even after the Disinflation, the inflation rate will remain positive. To sum up, Deflation is terrible compared to Disinflation. Now In case, you see these terms in financial articles, you can get a reasonably good intuition.

Lets now get into stagflation, which is a very tricky situation wherein the GDP growth remains "flat" However, Prices continue to increase, which is counter-intuitive to our earlier view that GDP and inflation rate are positively correlated. Iain Macleod, a British politician, is credited for using the term stagflation in the year 1965.

"We now have the worst of both worlds — not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of 'stagflation' situation. And history, in modern terms, is indeed being made."-Iain Macleod

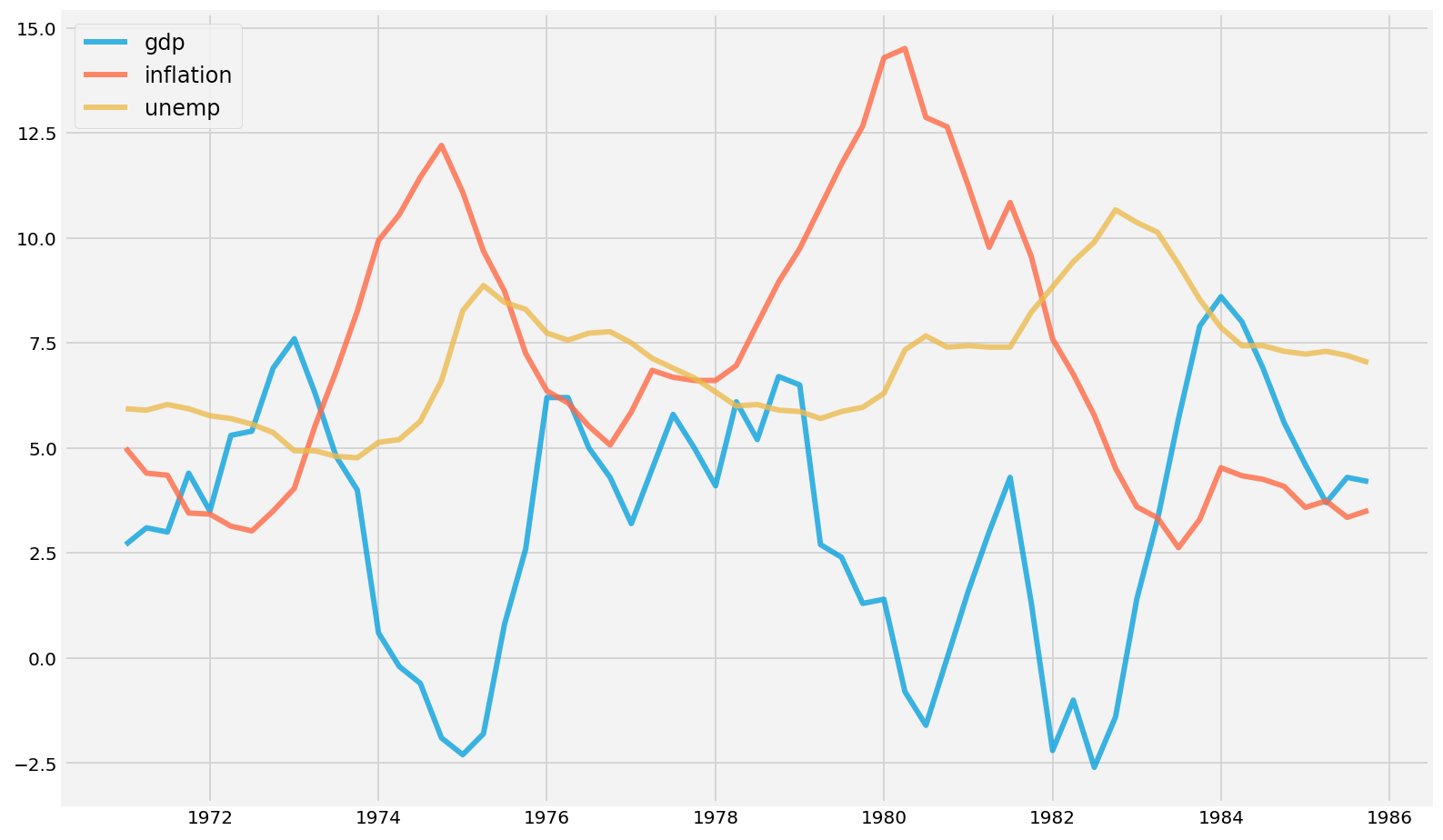

Stagflation is a perfect storm of low to no growth in GDP with high inflation accompanied by the high unemployment rate.

Any countries central bank deploys contractionary policies to curb inflation. Expansionary policies help curb unemployment.

In the case of stagflation, the central banks carefully navigate the situation.

Years from 1973-1975 in the above graph from the US economy represents a period of stagflation as we see GDP drops while both Inflation and unemployment both increase.

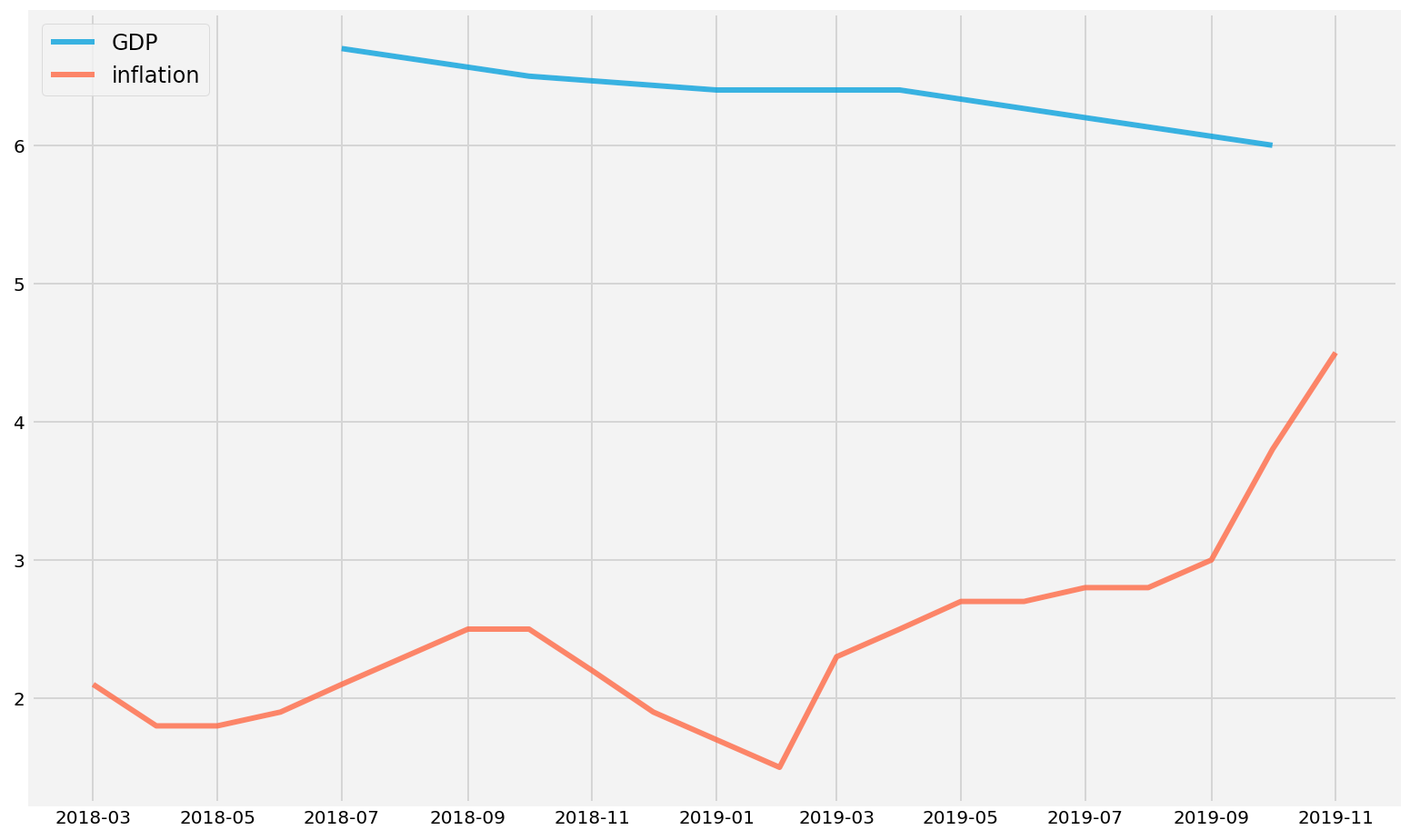

Most often, there is speculation in the markets whether a country is entering or currently in stagflation. For example, as of this writing, there is speculation if china will be entering stagflation as the inflation rate has increased while the GDP growth is declining or flat.