GameStop and Short Squeeze

Background

Most of you may already be aware of the episode with GAME STOP (NYSE: GME) stock ,which is now all over the news. The sequence of events went something like this. There was a high level of short interest in "GME." Allegedly an increased number of retail investors from the Reddit 'wallstreetbets' forum noticed a high short interest in GME. Retail investors then started purchasing the stock, raising the stock value, and forcing a 'short squeeze,' which lead retail fintech brokerage firms such as Robinhood to halt trading on specific stocks to meet the stock clearinghouse collateral requirements. Robinhood raised capital to meet the collateral and has since then allowed its customers to trade these stocks. The new U.S administration and SEC are closely monitoring the situation for any foul play scheme such as "pump and dump."

The above summary is a good starting point, but now let's break down and understand some of the fundamental components involved.

Short selling

Let's first understand what is short selling. Let's say you buy a stock at $10; the upside(gain) of the stock is limitless, assuming the company keeps doing well and the downside(loss) in the stock is only $10.

However, a short sell position will reverse the gains and losses. The stock's upside will be $10, the price at which the stock was "shorted." Assuming stock will lose its value to $0 (stock can never have negative value), and the downside(loss) will be limitless (assuming stock continues to do well).

How does one get into a Short position?

When an investor "shorts" a stock, they will enter into a margin position by borrowing the broker's stock. Let's say investor shorts when the stock was at $10, and then he will wait till the stock price goes down and then will "cover." his short position to make profit. Let's say the stock went down to $6. The investor will buy to "cover" his position and pockets the difference of $4 as his profit.

Short Squeeze

Now that we understand short selling ,let's dig into the short squeeze -the process that has caused a meteoric price increase in stocks such as GME, AMC, etc.

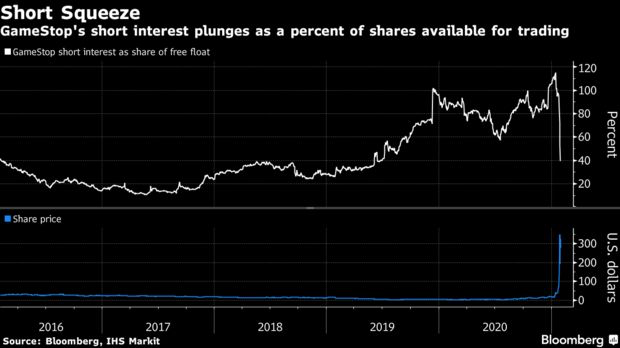

For any asset, the market will have longs and shorts. Longs are bullish on the investment in the long term, whereas the shorts are bearish. In a short squeeze scenario, the number of long positions increases, which reduces the asset available to purchase, causing the price increase of the underlying asset without any actual fundamental change in the business.For example GME did not revamp their business model in terms of cost or revenue but the stock price just start to rise. The price increase makes the shorts nervous since they may get a "margin call" from their broker. Hence, they go into buying frenzy to cover the shorts. Now, we have a perfect storm, a whole bunch of longs and shorts on the same side of the trade , further increasing the stock price.

What is a margin call?

The shorts must have a minimum maintenance margin as the underlying asset price increases; the broker will ask the shorts to cover the position(i.e., buy the asset) or add more funds to the margin account.

Let's say you if one decides to short 100 stocks at $1 each. Therefore the total short sale value will be $1000. The initial margin typically will be 150% of the short sale value, which will be $1500, so to open this short position, the individual must have at least $1500 in equity or cash in the account.

Once a short postion is opened,there is will be ongoing margin maintenance, this margin percentage can vary, but for this example, let's take that as 25%.

If the underlying stock jumps to $2, the short sale value will be $2000, and the maintenance margin will be 25% off $2000 = $500.therefore total margin requirement will now be $2500.the individual will get a "margin call" for $1000 ($2500-$1500).

If the underlying stock drops to cents, the short sale value will now be $500 and maintenance margin will 25% of $500 = $125, and total margin requirement will $500+$125 = $625, which is less than $1500 and individual will not get any margin call.

Short interest as a percent of Float or Shares Outstanding

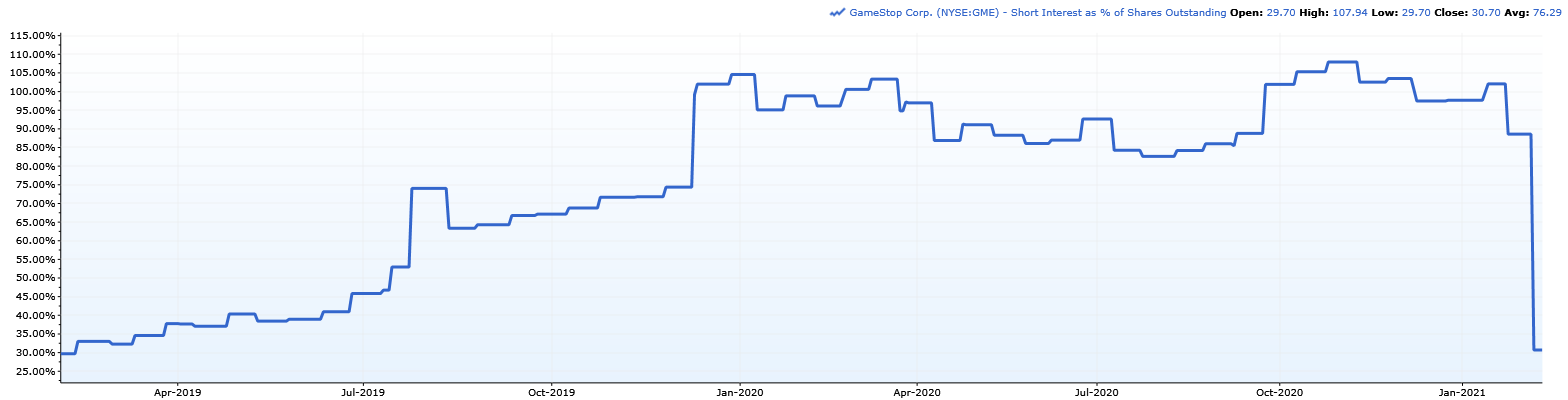

Now that we understand short-squeeze and margin call. Let's review the concept of short interest as a percentage of total shares outstanding and short interest as a Float percentage. Ongoing GME saga is often associated with these metrics.

Shares outstanding=Shares issued – treasury stock (i.e., shares the company repurchased).

Investors can quickly obtain this number by reviewing the balance sheet.

Short interest as % of Shares Outstanding is the ratio of the number of shorted shares to shares outstanding

And,

Float (is total share available for the general public)=shares outstanding - Restricted and CloselyHeld Shares (i.e., stocks owned by company insiders)

Short interest as % of Float is the ratio of the number of shorted shares to floating shares.

For example, GME shares outstanding are 69.7M, and Float is approximately 68% of shares-outstanding =68% of 69.7M= 47.3M.

During mid-January, the short interest as % of Float was around 117%, which meant investors shorted more stocks than the "Float."

Why did retail brokerage firms halt trading on GME?

The Depository Trust & Clearing Corp (DTCC) is the central clearinghouse for U.S traded stocks. Retail brokers such as Robinhood need to maintain a "collateral" (deposit) because of lag("T+2" rule) between the exchange of cash to the actual underlying security. Analogous to the "margin call" to individual investors but this is a contract between retail brokers and DTCC.

DTCC realized the risks with the short squeeze sale and ordered brokerage firms to increase their "collateral."Robinhood had to meet nearly $3B(i.e., Three Billion) worth of collateral.

So what's next?

There is currently an ongoing SEC and the federal government investigation to find out corrupt individuals involved in any coordinated "pump and dump" tactics. i.e., to see if a set of bad actors drove the price high profited and then started to dump the stock.

In Conclusion, this appears to be another financial debacle that no one expected. At least our open and free market showed resilience and did not collapse the entire market. Further learning from these incidents and incorporating necessary changes will make our markets even more robust.