What are different Payment Networks?

In the previous post, We reviewed how digital payments work through credit card networks .We also went through different players involved that ensure a successful digital payment transaction between a buyer and a seller.

This post will review other digital payments or money movement between two consumers (Peer to Peer or P2P ) or between consumers and businesses.

To obtain economies of scale and regulation compliance all money transactions will run through one or the other networks. Below I am considering payment methods in the United States, same procedures will apply in other countries with some variation based on regulation requirements.

Debit Cards

Similar to what we saw in credit card processing in debit card processing, the issuing bank will provide a debit card to its customers. The Issuing bank associates the debit card with the consumer's checking/savings accounts.

The critical difference between a credit and debit card transaction from the issuing bank perspective is that the bank pays the amount required to complete a credit transaction. The consumer may have an empty bank account and still make a purchase. The consumer will pay back the issuing bank whenever the monthly credit card payment is due. If the consumer doesn't pay off the amount in full, his issuing bank will charge him an interest rate.However, in a debit card transaction, the consumer is expected to have the money in his bank account to purchase.

For example, if a chocolate box costs $100 in a debit transaction, the consumer must have $100 cash deposited in this bank account. However, in a credit transaction, as long as the consumer has a $100 credit line (i.e., the ability to borrow money from a bank), he can buy the chocolates even without having cash in this account.

Similar to credit card transactions, there are three stages for a debit transaction.

(a) Authorization

Debit cards can be used as either debit cards or credit cards for a transaction (i.e., either withdraw cash from a personal account or credit line). The consumer makes this choice at the time of purchase or at time choice is made by the merchant.

Most of you may have experienced this during your run to the grocery store. When using a debit card, we must enter a "pin" to make a purchase (similar to withdrawing money from the ATM) or use our signature on the P.O.S (point of sale) device.

A "pin" based transaction is a debit transaction, and a "signature" based transaction is a credit transaction.

Let's review some steps

- Consumer pulls up his/her debit card to purchase goods at the merchant and enters their debit card "pin" at the P.O.S.

- By entering the pin, the customer has chosen debit transactions.

- P.O.S captures the information and sends it to the processor.

- The processor sends the info to the issuing bank.

- The issuing bank will perform validations (such as verify existence of account, verify for cash availability, among various other checks) and send a success or failure for authorization.

- The authorization message goes back to the POS through the processor.

If the issuing bank sends a successful authorization, the transaction is complete, and the buyer can finish his purchase.

(b) Clearing.

During clearing, the merchant (typically end of the day) sends all the successful sales transaction information to the processor. The processor then sends the information to the respective issuing banks.

(c) Settlement.

In this stage, the issuing bank transfers the funds to the acquiring bank through respective networks.

Digital Wallets

Digital wallets are specialized software that's present in mobile phones that helps facilitate mobile payments.

Plastic cards replaced cash; now the digital wallets are replacing plastics.

Wallets can be of following types.

(a) Pass through digital wallet (proxy wallet)

In this case, instead of carrying your debit or credit plastic cards in your pocket wallet, you will be holding the digital version of these cards on your smartphone.

(b)Stored value wallet

In this case, the wallet holds actual digital currency, and a customer will have an account associated with the wallet. The customer must "fund" the account before performing any purchase with the wallet. Such a setup is analogous to a prepaid debit card or gift card.

(c) Staged digital wallet

This is an extension to a "stored value card" wherein a customer can perform a "live load," i.e., even when the wallet owner doesn't have enough funds, he could load his wallet during an actual purchase in real-time.

Let's review the cases in the context of a transaction,

- Consumer pulls up his phone and swipes against the POS.

Case a:

if it is a proxy wallet-based transaction - the transaction will be the same as any credit card transaction.i.e., the usual flow we have discussed earlier involving P.O.S, Processor, issuing bank, an acquiring bank.Here the proxy wallet acts as a replacement for the physical credit card.

Case b:

For a stored-value wallet, the merchant P.O.S can interact directly with the digital wallet. However, if the wallet doesn't have enough funding, the purchase will be declined.

In the case of the stage-value wallet, there are two-stages in the processes. The first stage will be the funding stage, where the wallet provider ensures the account has the required amount to complete the transaction. And in the second stage, the actual purchase occurs, and all this happens in real-time within the digital wallet. Unlike the stored-value wallet, both stages occur in real-time.

Check

Oldest form of exchange of money between individuals or businesses after cash is Check. The United States passed a law called "check 21 " after the 9/11 incident. This act has changed Check handling in the United States. The act's critical change was that banks could use an "image" of a Check instead of physical paper to complete check transactions. Before the passing of this act, $6 Billion worth of Checks were in the air(yes in planes) on any given day in the United States. In case of an escalation or crisis if the planes are not allowed the fly (such as during the 9/11 incident) , then nation's economy could come to a standstill due to liquidity crisis in the market

"Nearly all the checks the Federal Reserve Banks process for collection are now received as electronic check images. -" U.S. Federal Reserve Bank.

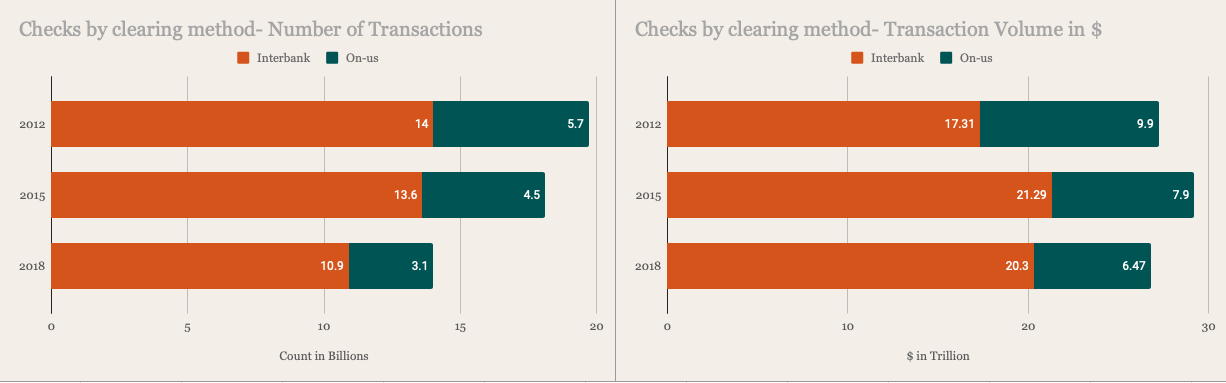

There are two types of check processing: (a) "inter-bank check." The checks deposited and drawn are from different banks. (b) "on-us checks"-where the checks deposited and drawn are from the same banks.

Around 78% of checks were processed in the U.S. in 2018, where "interbank checks" accounting for approximately 76% of the dollar amount transacted through checks in the year 2018.

On-us Checks

Let's start with "on-us" checks. let's assume both the "payer" (person sending the money) and "payee"(person receiving the money) have bank accounts in the same institution. "payer" provides the Check to "payee." "Payee" deposits the Check in his bank. The bank debits the amount from the "payer" account and credits the "payee" since both have accounts in the same bank.

Interbank Checks

Let's move on to "interbank check" where "payer" and "payee" having accounts in different banks. Once the "payer" deposits the Check in his bank. Let's call this bank a "depositing" bank. The bank will then need to process the Check and get money from a different bank . Let's call the "payee" bank as "issuing bank."

The depositing bank has various options to process the checks.

(a) Reserve Bank

A bank can send the "image" of the Check to the reserve bank. The reserve bank will debit the cash from the "issuing bank" and "credit" the depositing bank

(b)Check clearinghouse

The "issuing bank" and "depositing bank" can be members of the check clearinghouse. Then the member banks make direct transactions with each other using a "settlement bank." The main advantage of check clearinghouses is that the clearinghouse rules govern member banks, and each bank need not have to work out separate settlement agreements.

(c) Correspondent financial institution

The "depositing bank" can send the "image" of the Check to a "correspondent"(Think of correspondents as "bank of banks"). Corresponded banks credit the "depositing bank" and then collect the money from the "issuing bank."

(d) Direct contact with the "issuing bank"

The "depositing bank" can send the "image" of the Check directly to the "issuing bank." the "depositing bank" and "issuing bank" must have settlement agreements in place.

Automated Clearing House (ACH)

ACH payments are electronic payments from one bank account to another. ACH payments are very prevalent and used during transactions such as salary deposits and bill pay services from the bank's checking account. ACH payments were invented in the 1970s to reduce "paper" volume resulting from checks.

ACH Payments are of two types

(a) ACH Debit - known as "Direct Payment"

This is a "pull" transaction, i.e., an institution will "pull" money from your bank account. The most popular ACH debit transaction is bank bill payment done by consumers to their service providers.

(b) ACH Credit - know as "Direct Deposit"

This is a "push" Transaction, i.e., an institution will "push" money to your bank account. The most popular ACH Credit Transaction is the employer's salary deposit to an employee's bank account.

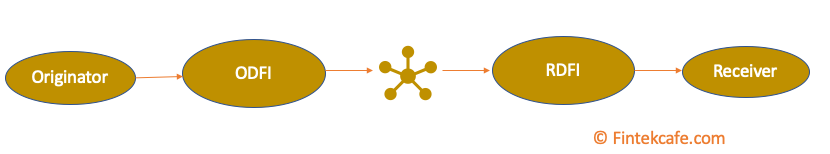

Who are different players involved in ACH?

(a)Nacha(National Automated Clearing House Association)

Nacha is the central governing body of the ACH network. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services

(d) Originating Depository Financial Institution (ODFI)

ODFI is a bank that processes the transaction on behalf of the "originator."

(e)Receiving Depository Financial Institution (RDFI)

RDFI is the bank that processes the transaction on behalf of the "receiver."

(f) ACH operator

Operators act as intermediaries between ODFI and RDFI and facilitate the members' settlement operation. The Federal Reserve Bank and "The clearinghouse"(TCH), which owns the Electronic Payments Network (EPN), are the two leading operators in the U.S.Inter "operator" settlement is done by the Reserve bank.

(g)Receiver

The Receiver is the primary entity in ACH transaction, be it a direct deposit, where the receiver is "credited" with the amount. Example: An employee working in a company and receiving the salary through "direct deposit" is a "receiver."Or Direct Payment, where the receiver is "debited" with the amount. Example: Consumers paying their utility bills. In ACH terminology, in this case, the Consumer is the "receiver."

(h)Originator

The Originator is the company that processes the ACH transaction. The originator is liable for the transaction in the ACH network,and they either credit or debit the receiver's bank account. In the receiver example above, the employer and utility companies are the originators.

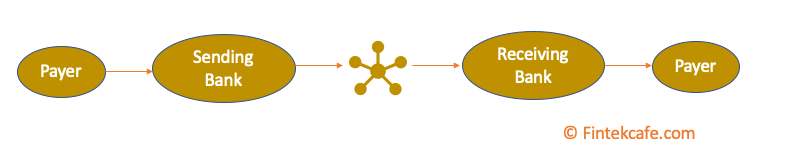

Wire

Wire transfers have been prevalent since the late 1800s where people used the telegraph networks to "wire" (transfer instructions and relevant passcode) the money between two banks. Since then, the wire transfer has evolved.

Let us review the anatomy of a wire transfer. We will have (a) a "payer" (person/entity that is starting the transfer." (b) "payee" (person or entity making the transfer). (c) Sending bank - Bank holding "payer" account. (d) Receiving bank -The person or entity holding the "payee" account . (f) the "wire" transfer network.

Primarily there are three main types of wire transfer networks.

(a) FedWire.

In this mode of "Wire" transfer, the participating banks will have an account in the federal reserve bank. And when money is "wired" between accounts present in the two participating banks. The federal reserve will debit the "sending" bank and credit the "Receiving." Wire Transfers are irrevocable transactions. So sending bank bears most of the liability, sending bank must ensure enough funds (collect from the "payer" or provide a one-day "loan" assuming a pending deposit transaction the "payer" account) are present to perform the wire transfer.

(b) Clearing House Interbank Payments System(CHIPS)

The second leading network for wire transfer is the "CHIPS." The main difference between CHIPS and FEDWIRE is that the C is private, and U.S. Government owns FedWire. CHIPS has around fifty participating member banks.CHIPS is a customer and competitor for Fedwire. Most of the international wire transfers occur over chips.

(c)Society for Worldwide Interbank Financial Telecommunications (Swift)

SWIFT isn't a traditional payment method in the sense, it doesn't manage any accounts or funds. SWIFT is simply a messaging service. Each participating organization with an eight or eleven-digit unique number. The payer will go to the sending bank and give the "payee" account number and "Receiving bank" swift number. The sender bank will send a "swift" message with account details to the receiving bank, and the receiving bank will credit its member's account.

ATM

Interbank network or ATM network is another common form of network that we as banking consumers use regularly. Here are few scenarios for the ATM network. A Bank customer may directly withdraw money from his bank account using his bank ATM - this transaction is usually free as part of the customer's checking/savings account. A customer may go to another bank and make an ATM withdrawal transaction. If the two banks are in the same ATM network, then the ATM network may add a fee that the ATM network will withdraw from the customer's bank account. If the other bank is not part of the ATM network, the other bank will most likely charge higher fees for money withdrawal.

Some of the popular ATM networks in the U.S. are star networks owned by First data. Fiserv owns MoneyPass. Fidelity National Information Services own the new York Currency Exchange (NYCE). These networks' settlement goes through Fedwire and CHIPS payment system, which we discussed in the "wire" transfer section.

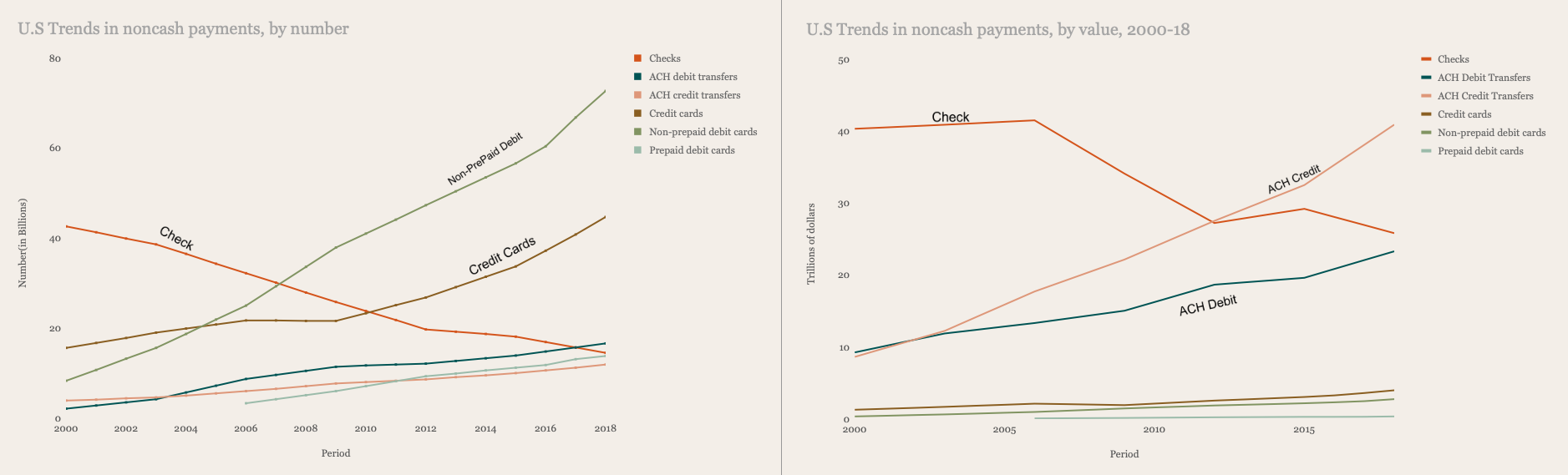

Current State of Payment System.

The FRPS data published by the U.S. government clearly shows that there is high volume with a Year Year increase of credit and debit card transactions.However, the Check based transactions are declining Year over Year.Also, ACH debit and ACH credit-based payments increase year over in dollar value and outpacing the declining Check based transactions.

The 2019 Federal Reserve Payments Study (FRPS), seventh in a series of triennial studies, found accelerating growth overall in core noncash payments from 2015 to 2018 compared to the previous three years. Automated clearinghouse (ACH) and card payments accelerated, while Checks continued to decline over the same period.

Fintech revolution is currently underway, and we can expect to see a shift towards decentralized payment systems.