What are NFT (Non-Fungible) token ?

Non-Fungible token (NFT) has become all the rage after the digital artist known as Beeple sold one of his art pieces -"Everydays: The First 5000 Days"- a collage of all the images that Beeple has been posting online for the last 13 years- for $69 Million. Beeple auctioned his artwork at Christie's, and the sale made Beeple the top three most valuable living artists

.@beeple 's 'The First 5000 Days', the 1st purely digital NFT based artwork offered by a major auction house has sold for $69,346,250, positioning him among the top three most valuable living artists. Major Thanks to @beeple + @makersplaceco. More details to be released shortly

— Christie's (@ChristiesInc) March 11, 2021

Before we get into the details of NFT, let's look at some of the other NFT deals that are making the news as of this writing. Artist Claire Boucher known as Grimes has sold $6M of NFT. Electronic musician 3lau made $11.7M selling NFT of his songs and albums. Chris Torres, the artist, sold his YouTube internet meme sensation "Nyan Cat" from 2011 for $580,000.A single Twitter post of Dallas Mavericks owner Mark Cuban went for $952.The first tweet by Twitter founder Jack Dorsey is set to be sold for $2.5M. A video clip of Basketball superstar Lebron James's block shot went for $100K. The below table shows the "top 10" by the total value of NFT "products" sold in just the last 30 days of this writing(March 13, 2021).

----------------------------------------

| | Product | Value |

|----|-----------------|-----------------|

| 1 | NBA Top Shots | $295,804,923.00 |

| 2 | CryptoPunks | $122,201,352.81 |

| 3 | Hashmasks | $22,482,508.74 |

| 4 | Sorare | $14,864,513.52 |

| 5 | Art Blocks | $9,514,244.39 |

| 6 | Axie Infinity | $3,157,517.38 |

| 7 | CryptoKitties | $2,802,551.82 |

| 8 | Street Fighter | $1,633,690.68 |

| 9 | Bitcoin Origins | $478,024.83 |

| 10 | Alien Worlds | $367,812.93 |

----------------------------------------NFT and What are they?

Before we find out what are "Non-Fungible" assets, let's first understand "fungible" assets.

"being something (such as money or a commodity) of such a nature that one part or quantity may be replaced by another equal part or quantity in paying a debt or settling an account" - Definition from Webster Dictionary

Cash and commodities such as wheat, corn, iron, gold, etc., are fungible assets in our physical world-i.e., wheat, corn, etc. have a physical existence. Now that we are transitioning to the digital world, what would be fungible digital assets? One classic fungible digital asset are cryptocurrencies such as Bitcoin(BTC) and Ethereum(ETH)

Now that we have established "fungible" goods. Let us review the meaning of non-fungible good

not easy to exchange or mix with other similar goods or assets - Definition from Cambridge dictionary.

Non-fungible physical assets include artwork from famous artists, memorabilia of sports players and pop culture stars, limited edition, or one kind good - for example, one of the 25 manufactured Lecia 35mm camera from 1923 went for $2.8Million in a 2012 auction. Non-Fungible digital assets - current assets include any digital content t - be it your Twitter post, photos, video clips, memes, digital clip art - folks are just getting creative to create new forms of digital NFTs. Digital NFT's are also creating a new class of "Asset-backed securities," and in some cases, the physical asset need not exist after the asset has been securitized.

NFT is based on "ERC(Ethereum Request for Comments)-721 Non-Fungible Token Standard".

NFT vs Cryptocurrency

Similarities

- Both use blockchain technology

- Both can trace every transaction

- Decentralized transaction.

- Secure - All transactions are encrypted.

- Transparency - Transaction ledger is public.

Differences

The key difference between the two is the fact that cryptocurrency in a blockchain has the same value. However, NFT has a unique value.

For example, Bitcoin (cryptocurrency) in Person A's wallet will have the same value as the Bitcoin in Person B's wallets and can be exchanged. ($1 bill with Person A will be the same as $1 bill with Person B. However, each NFT has a unique value(let us say person A has "CryptoPunk 4640" NFT in his wallet and Person B has "CryptoPunk 4741," both have different values in the marketplace).

NFT transaction

Let us take a recent example, Bansky - a popular England-based street artist- had five hundred physical prints of his painting called "morons." One of the prints (print #325) that was authenticated by "pest control"-The only official body that can authenticate any Banksy print - was purchased by a blockchain company called Injective Protocol for $95,000. The company later burnt the painting in a Twitter live stream and announced that the painting would be sold as an NFT on Opensea - an NFT marketplace.

"We entirely recreate the physical piece and input specifications, such as the art version number into the smart contract code, [so] no one can ever alter the digital art in any way," "The physical piece will forever be memorialized in this NFT." - Injective Protocol executive

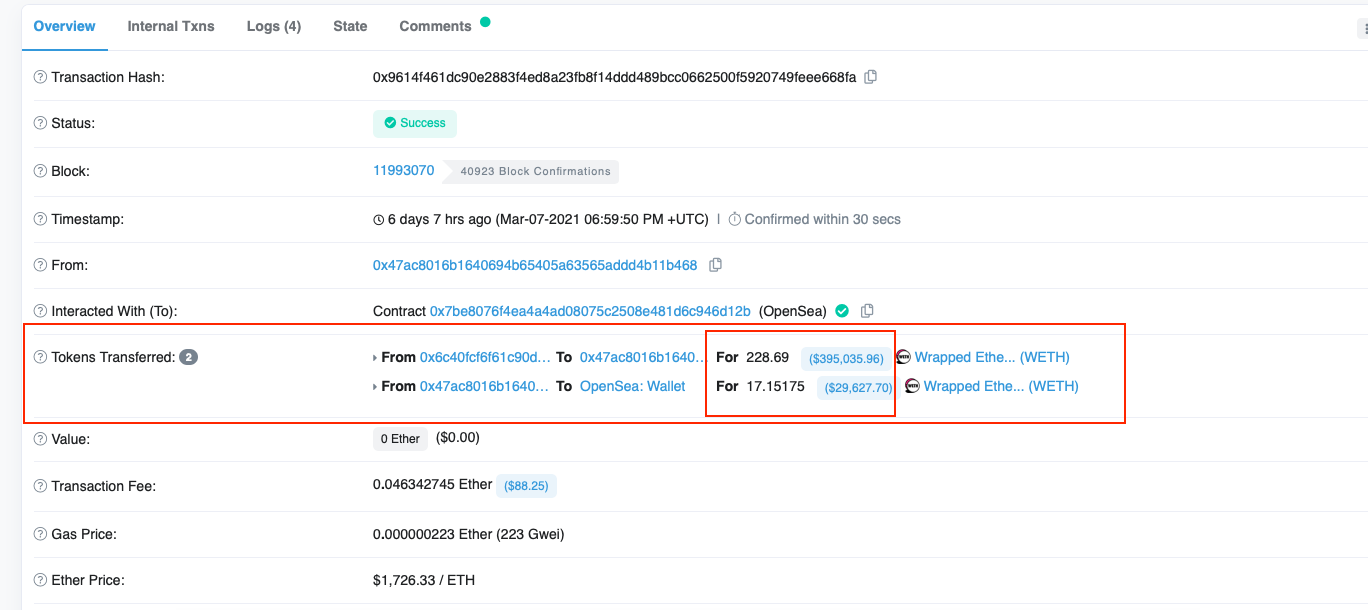

The NFT was purchased earlier this week for around $395,000 - below are the "smart contract" details that capture the transaction. As we can see, the token holder 0x6c40fc.... paid to token holder 0x47ac80... a total 228.69 WETH (wrapped etherium), USD $395k on day of the transaction.

What drives the price of Non-Fungible physical assets, and will the same apply to Non-Fungible Tokens?

Let us review what drives the prices of Non-Fungible physical assets.

(a) Supply and Demand: According to Economic theory, the demand curve is downward sloping for "Normal Goods," i.e., price and quantity demanded are inversely proportional - i.e., as price increases, the quantity demanded decreases. As price decreases, the quantity demanded increases). However, for "Veblen Goods" (Luxury or Collector items), the demand curve is upward sloping, i.e., price and quantity demanded are directly proportional. i.e., as price increases, the quantity demanded increases. As price decreases, the quantity demanded increases. American Economist Thorstein Veblen coined the term "conspicuous consumption" to explain this behavior, i.e., certain members in the society spend disposable income on luxury (non-essential) items to acquire or maintain their social status.

(b) Exclusivity - A more exclusive or rare asset will draw more bidders.

(c) Proof of Authenticity - A art collection that has been verified and authenticated will garner a higher price.

(d) Original Artwork - If artwork has one any restoration or has been damaged, then the asset price decreases.

(e) Trail of Acquisition - A trail of initial acquisition including all the in-between hand-offs will get a high asset price.

NFT does a good job of digital recording keeping and provides transparency, and no doubt is a boon for art auctions or rare physical assets.

The democratization and decentralization of media is the biggest change of the 21st century. Both the consumption and creation of content have gone digital. Now any individual can have their own "print media" (e.g., the blog that you are reading) and "broadcast media" -the video content(all forms- songs, news, and education) that we view on platforms such as YouTube and audio content that we hear through the various podcast. NFT is geared for this new digital world - one of the biggest benefits of NFT is that it provides a unique opportunity to invest in up-and-coming artists. It's like investing in DA Vince's painting during his early years before he became famous. This is good both for the investment and the art community alike.

Another advantage of NFT is that the underlying physical asset can get destroyed, and yet the tokenized version of the asset can stay in the digital world forever ( as we saw with the Bansky painting example above)

What goods can be sold as NFT, and where to trade?

Goods

NFT can be any physical or virtual goods into NFT. Virtual goods such as video games, avatars, memes, tokens, images - have to be creative. Any real-world physical good can be tokenized (i.e., "NFTised" ) such as artwork, cars, houses, shoes.

Trade

Some of the most popular marketplaces for NFT as of 2021 include Opensea, Rarible, Superare, Nifty gateway, Foundation, Axie Marketplace, Bakeryswap, NFT showroom, VIVE.

Different marketplace uses different blockchain, so before venturing into NFT, one must research the trading platform's supported blockchain. Ethereum is the popular blockchain network for NFT. Some of the other popular Blockchains include Binance Smart Chain, Flow, Tron, EOS, Polkadot, Tezos, Cosmos, WAX

What caused the rise of NFT?

The recent COVID pandemic and lockdown have made consumers get creative in earning additional income. We have seen that with recent activity by retail investors on the Gamestop stock and now with NFT. For example, NBA Topshot - A NFT based online marketplace where members trade "NBA moments," a short NBA basketball game clip has seen a spike in its usage and has traded nearly $250M of assets in the last 30 days.

Also, due to the pandemic, many of the industries have suffered very badly. For Example, the music industry is heavily hit, and artists cannot earn their income through concerts. So artists such as 3lau got creative and started to use NFT to sell their "digital goods."

Where is NFT headed?

The skeptics will call the NFT trend a bubble and expect the bubble to burst soon? The main argument is that copyright laws protect digital assets, and NFT doesn't provide any form of exclusivity in terms of payments. For example, all "NBA moments" purchased on NBA top shots can be viewed by anyone- the NFT owner doesn't get any royalty payments for the video. However, Tidal's recent purchase by fintech company Square alludes to future synergies that can be created with digital music and artist content and trading them as NFT.

NFT as a cryptocurrency asset is here is stay - we would have to wait and see which markets will benefit from this trend.