How does digital payments work?

In this article, we cover the basics of credit card processing. You will learn about each component in the payment ecosystem, how they connect, and which major companies operate at each layer.

Let's start with a simple example: buying a coffee at your favorite cafe using a credit card.

From Cash to Cards

Before credit cards existed, the process was straightforward. You earned a salary, deposited it at your bank, withdrew cash from a teller, and paid for things in person.

Then banks introduced debit cards — a plastic version of cash. Instead of withdrawing money first, you could swipe a card at the store. Customers saved a trip to the bank. Banks saved money on tellers and ATMs.

Banks then went a step further with credit cards. Now you could buy something even when your bank account was empty. The bank extends you a line of credit, and you pay it back later. Our coffee-buying friend can now get his latte even before payday.

The Building Blocks

Now let's add the building blocks of credit card processing, one by one.

The bank that issued your credit card is called the "Issuer Bank."

The cafe owner (the seller) is called the "Merchant." The merchant needs a bank account to collect payments. This bank is called the "Acquiring Bank." Sometimes the merchant's corporate account is at a different bank — in that case, the acquiring bank transfers funds to the merchant's corporate account.

Other players in the acquirer ecosystem help sign up new merchants. "Independent Sales Organizations" (ISOs) are agencies authorized to resell acquirer solutions. "Payment Facilitators" (PayFacs) can sign contracts directly on behalf of the acquirer.

So now we have two sides: a buyer (with an issuing bank) and a seller (with an acquiring bank). But there are thousands of issuing banks and thousands of acquiring banks. Who connects them?

The "Credit Card Network" is the glue that connects issuers with acquirers.

Open vs. Closed Networks

There are two types of credit card networks:

In an "Open" network, the network only facilitates transactions. It earns revenue by charging fees to merchants and issuing banks. Visa and Mastercard are the most popular open networks. Any bank can issue a Visa or Mastercard.

In a "Closed" network, a single entity acts as both the issuer and the network. American Express and Discover are closed networks. For example, Bank of America can issue a Visa card — but it cannot issue an American Express card, because Amex issues its own cards.

Gateways and Processors

Merchants don't connect directly to card networks. Several intermediaries help route the transaction.

First, merchants integrate with a "Payment Gateway." The gateway is the interface — a POS (point-of-sale) terminal in a store, or a checkout page online.

There are two types of gateways:

"Agnostic gateways" provide a single interface to connect with multiple acquirers and processors. They also offer value-added services like fraud detection and failover routing. If a merchant switches acquirers, no changes are needed on the merchant's end — the gateway handles it. CyberSource and Authorize.Net are examples.

"Dedicated gateways" are owned by an acquirer or processor. The advantage is tighter integration and faster issue resolution. Chase and First Data are examples.

Gateways typically don't talk directly to credit card networks. They connect through "Processors." Processors handle payment authorization and fund settlement. They sit between merchants and the credit card networks. TSYS and First Data are examples of processors.

Putting It All Together

Now let's follow our coffee purchase end to end. We'll break it into two stages.

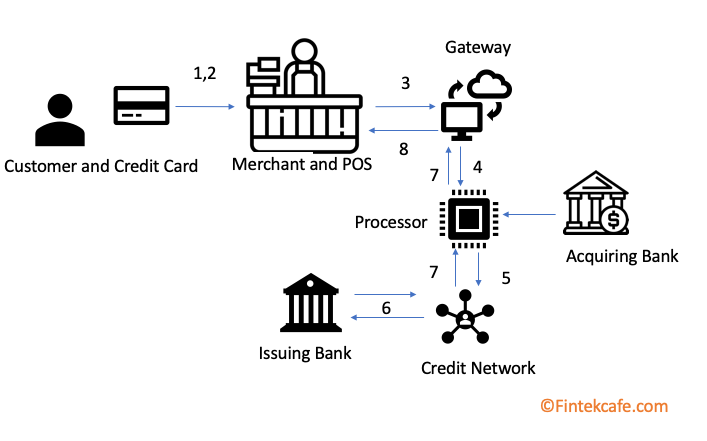

(a) Authentication and Authorization

At the end of this stage, the buyer has his coffee — but the cafe owner hasn't received the cash yet.

(1) Joe goes to his favorite cafe and orders a latte. The price is $5.

(2) Joe swipes his credit card at the POS terminal.

(3) The POS sends the data to the gateway, which formats it for the processor.

(4) The processor formats the data and sends it to the credit card network for authorization.

(5) The network validates the data and forwards it to Joe's issuing bank.

(6) The issuing bank checks Joe's account, verifies available credit, and sends back a response.

(7) The response travels back through the network to the processor.

(8) The processor sends it to the gateway, which displays the result on the POS terminal. Joe's purchase is approved.

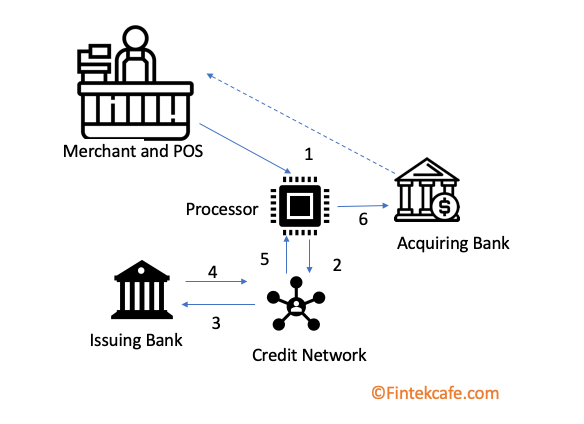

(b) Clearing and Settlement

At the end of this stage, both the buyer and merchant see the transaction on their statements, and the merchant has the cash in his account.

(1) At the close of business, the merchant sends all authorized transactions to the processor in a batch.

(2) The processor formats the data and sends it to the credit card network.

(3) The network forwards the data to each issuing bank.

(4) The issuing bank deducts "interchange fees" and sends the remaining amount to the credit card network.

(5) The network collects "assessment fees" and passes the rest to the processor/acquirer.

(6) The processor/acquirer takes its markup fees. The remaining money is deposited into the merchant's acquiring bank account.

In future posts, we will cover similar transactions involving digital wallets and break down the fee structures used by major credit card networks.